Udyog Aadhaar and MSME Registration

Hi Readers, in this article we will discuss about Udyog Aadhaar and MSME Registration. With the view to address policy issues related to MSMEs a separate law, The Micro, Small and Medium Enterprises Development (MSMED) Act was notified in 2006. The purpose of the MSMED Act was to facilitate development of these enterprises and enhance their competitiveness. The MSMED Act provides the first-ever legal framework which recognition the concept of “enterprise” that covers both manufacturing and service entities, first time medium enterprises were defined and that was in The MSMED Act. The Act also seeks to integrate the three tiers of these enterprises, namely, micro, small and medium.

The MSMED Act classified the Micro, Small and Medium Enterprises (MSME) in two Classes:

(a) Manufacturing Enterprises – An enterprise that is in the process of manufacturing or production of goods. Goods pertaining to any industry specified in the 1st schedule to the industries (Development and regulation) Act, 1951. We also define enterprises as that employed or used plant and machinery in the process of its value increase to the final product which having a distinct name or character or use. The Manufacturing Enterprise is further defined as Micro, Small and Medium enterprises in terms of investment in Plant & Machinery.

(b) Service Enterprises: An enterprise that is providing or rendering of services. Service enterprise is further defined as Micro, Small and Medium enterprises in terms of investment in equipment falls under Service enterprises.

The limit for investment in plant and machinery / equipment for manufacturing / service enterprises are as under:

Micro Enterprises :-

Manufacturing (“A” UAM Category) – Investment in Plant and Machinery or Equipment does not exceed INR 25 Lakh.

Service (“D” UAM Category) – Investment in Plant and Machinery or Equipment does not exceed INR 10 Lakh.

Small Enterprises :-

Manufacturing (“B” UAM Category) – Investment in Plant and Machinery or Equipment more than INR 25 Lakh but does not exceed INR 5 Crore.

Service (“E” UAM Category) – Investment in Plant and Machinery or Equipment more than INR 10 Lakh but does not exceed INR 2 Crore.

Medium Enterprises :-

Manufacturing (“C” UAM Category) – Investment in Plant and Machinery or Equipment more than INR 5 Crore but does not exceed INR 10 Crore.

Service (“F” UAM Category) – Investment in Plant and Machinery or Equipment more than INR 2 Crore but does not exceed INR 5 Crore.

The MSMED Act provided for registration of enterprises with District Industries Centre (herein afterwards refereed as DICs). After 2006 Entrepreneurs Memorandum i.e. EM-I for those enterprises that are yet to commence operation and EM-II for enterprises having commenced operations were required to file the requisite memorandum with the respective DICs.

The Kamath Committee commented to EM registration process as… “The major issue lies not with the registration process as per the MSMED Act, 2006 but with the conditions applied by the local DICs. There are different localized rules and requirements from district to district within the same state due to which there is result in delays in receiving the EM II acknowledgement”.

As per the recommendations made by Kamath Committee (the Ministry of MSME) in consultation with the National Board of MSMEs and the Advisory Committee in this behalf has came with a single page registration form. Single page registration form constituted a self – declaration format under which the MSME will self-certify its details. self certify details is like its existence, bank account details, promoter / owner’s Aadhaar details and other minimum basic information required. Based on the self-certify above details, the MSMEs can be issued online a unique identifier i.e. Udyog Aadhaar Number.

It is twelve-digit Unique Identification Number provided by the Ministry and it is also known as Aadhar for Business

The earlier system of EM registration is was replaced with filling of Udyog Aadhaar Memorandum (herein afterwards referred as “UAM”) notified 18th September 2015

The purpose of UAM is to promote micro, small and medium enterprises. The registration of Udyog Aadhar is free. There is no cost on process of obtaining Udyog Aadhaar Number. The whole process is paperless and results in instant registration.

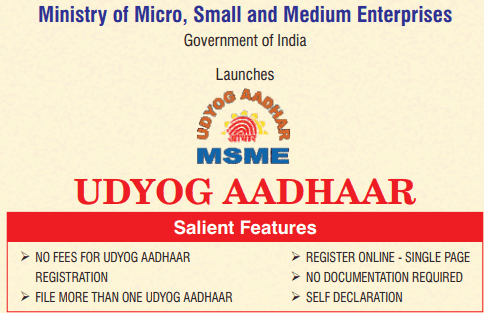

Udyog Aadhaar and MSME registration scheme was launched in September 2015 by Ministry of Micro, Small and Medium Enterprises under the Simplified one-page registration form is put in place.

- Registration is online and user-friendly;

- UAM can be filled on self declaration;

- No documents required

- No fee for filling

- File more than one Udyog Aadhaar within same Aadhaar number.

Introduction of UAM was a path breaking step to promote ease-of-doing-business for MSMEs in India. The UAM system replaced the need for filing Entrepreneurs Memorandum (EM Part-I & II). In the earlier mechanism filing EM by a Micro, Small and Medium Enterprise is put in place by respective States and Union Territories (UT). Earlier While some of the States / UTs have made the process online and several States / UTs were still depends on the manual way of filing EM. After the introduction of filing a single UAM online by enterprises located anywhere in India bring the uniformity among the state.

On recommendations for Universalization of Registration in the Report of the Kamath Committee with so many consultation exercises in the National Board of MSMEs and the Advisory Committee for MSME Act, it was expected to get a simplified one-page Memorandum that can be filed online and surely unlock the potential of MSMEs, besides improving India’s international ranking in doing Business Index.

The UA Portal, http://udyogaadhaar.gov.in is for online filing of UAM by enterprises located anywhere in the country. The UA portal http://udyogaadhaar.gov.in is also accessible on mobile devices.

UAM is beneficial in many ways. The registration will make the units / enterprises capable of getting relevant information and apply online about various services that are being offered by various Ministries and Departments.

Before introduction of The MSMED Act provides only medium enterprises were insisted to file EM2 and it was very cumbersome to file, with introduction of a simplified Udyog Aadhaar, all enterprises become capable of filing and registering themselves and thus by getting Udyog Aadhaar Unique identity code the enterprises can access other services.

Also See, “Refund claim under GST”

Important Note: If you are interested in writing a guest post for taxhouseindia, done an email at taxhouseindia@gmail.com with guest post ideas. If your article is published then we will promote your guest post to our audience through all channels including but not limited to social media, email newsletter, communities and groups.

For any query you can write at taxhouseindia@gmail.com. Before making any decisions do consult with your professional or tax adviser.

If you enjoyed this post, we will be very grateful if you’d help to share it by emailing it to a friend, or sharing it on twitter or Facebook. Thank You!

Don’t forget to subscribe us for Free Tax Updates through mail.

Also Join Our Telegram Channel by clicking here for Free Tax Updates.

Thank you So much for sharing such useful information, we are also well qualified for micro small & medium-sized companies with the MSME New Udyam Registration processing system.

MSME Registration Consulting Services helps startups and entrepreneurs get registration and certification for all processes of the Indian government.